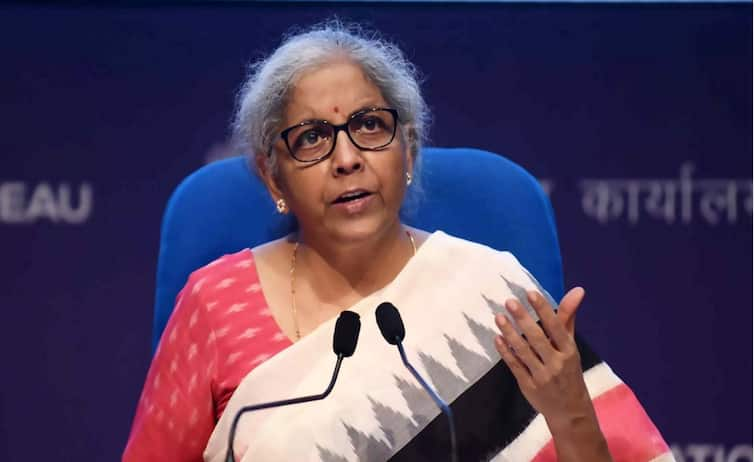

Finance Minister Nirmala Sitharaman To Table New Income Tax Bill Today

Union Finance Minister Nirmala Sitharaman will present the updated Income Tax Bill, 2025 in the Lok Sabha on Monday, following the clearance of the revised draft by a Select Committee. The bill, intended to replace the Income Tax Act of 1961, incorporates around 285 recommendations from the committee, which had submitted a comprehensive 4,500-page report to Parliament last month. The initial draft was first introduced in February during the Budget session. Last week, the government withdrew the earlier version from the Lok Sabha, stating that an improved draft would be brought forward, reflecting the committee’s inputs in full. Major Amendments in the Updated Draft The revised bill now integrates most of the suggestions provided by the Select Committee, which reviewed the proposal after its introduction in February. Many of these changes are aimed at simplifying the language of the legislation, refining phrase alignment, making consequential adjustments, and improving cross-references within the draft. One notable decision concerns anonymous donations to religious-cum-charitable trusts. The new bill retains exemptions for such contributions when received solely by religious trusts. However, religious trusts that also operate other charitable activities—such as educational institutions or hospitals—will not enjoy this exemption for anonymous donations, which will instead be subject to taxation. Also Read : Markets Remain Anxious Amid Tariff Turmoil, Sensex Above 79,860 Committee’s Review Process and Government Position After its introduction in the House earlier this year, the bill was immediately referred to the Select Committee for detailed examination. Headed by BJP MP Baijayant Panda, the committee submitted its recommendations on 21 July. The government explained that the decision to withdraw the earlier draft was taken to avoid confusion arising from multiple versions of the legislation and to ensure that lawmakers had a single, updated document for consideration. Parliamentary Affairs Minister Kiren Rijiju addressed concerns about the withdrawal, saying, “It is being presumed that there will be an absolutely new bill, ignoring the earlier bill for which a lot of work was done, and all the work done and time spent will go down," reported Moneycontrol. He clarified that such concerns were unfounded, as the revised bill incorporates all committee recommendations that were accepted by the government. The introduction of the updated Income Tax Bill in the Lok Sabha today is expected to be a key legislative moment in Parliament’s ongoing session, potentially shaping India’s taxation framework for years ahead.

Union Finance Minister Nirmala Sitharaman will present the updated Income Tax Bill, 2025 in the Lok Sabha on Monday, following the clearance of the revised draft by a Select Committee.

The bill, intended to replace the Income Tax Act of 1961, incorporates around 285 recommendations from the committee, which had submitted a comprehensive 4,500-page report to Parliament last month. The initial draft was first introduced in February during the Budget session.

Last week, the government withdrew the earlier version from the Lok Sabha, stating that an improved draft would be brought forward, reflecting the committee’s inputs in full.

Major Amendments in the Updated Draft

The revised bill now integrates most of the suggestions provided by the Select Committee, which reviewed the proposal after its introduction in February. Many of these changes are aimed at simplifying the language of the legislation, refining phrase alignment, making consequential adjustments, and improving cross-references within the draft.

One notable decision concerns anonymous donations to religious-cum-charitable trusts. The new bill retains exemptions for such contributions when received solely by religious trusts. However, religious trusts that also operate other charitable activities—such as educational institutions or hospitals—will not enjoy this exemption for anonymous donations, which will instead be subject to taxation.

Also Read : Markets Remain Anxious Amid Tariff Turmoil, Sensex Above 79,860

Committee’s Review Process and Government Position

After its introduction in the House earlier this year, the bill was immediately referred to the Select Committee for detailed examination. Headed by BJP MP Baijayant Panda, the committee submitted its recommendations on 21 July.

The government explained that the decision to withdraw the earlier draft was taken to avoid confusion arising from multiple versions of the legislation and to ensure that lawmakers had a single, updated document for consideration.

Parliamentary Affairs Minister Kiren Rijiju addressed concerns about the withdrawal, saying, “It is being presumed that there will be an absolutely new bill, ignoring the earlier bill for which a lot of work was done, and all the work done and time spent will go down," reported Moneycontrol.

He clarified that such concerns were unfounded, as the revised bill incorporates all committee recommendations that were accepted by the government.

The introduction of the updated Income Tax Bill in the Lok Sabha today is expected to be a key legislative moment in Parliament’s ongoing session, potentially shaping India’s taxation framework for years ahead.

What's Your Reaction?