Stock Market Today: Sensex Settles 740 Points Higher, Nifty Above 22,330

Indian benchmark indices, Nifty and Sensex staged a strong rebound from oversold levels, closing the session on Wednesday with gains of around 1 per cent after a period of market decline. This rally puts the Nifty 50 on track to break its 10-day losing streak, marking a historic first. Information technology, metal, and automobile stocks led the charge, offsetting losses in some key index heavyweights. However, analysts remain cautious about the sustainability of this recovery, as global financial markets continue to face uncertainty, with ongoing concerns over trade wars. At the close, the Sensex jumped 740.30 points, or 1.01 per cent, to finish at 73,730.23, while the Nifty gained 254.65 points, or 1.15 per cent, ending at 22,337.30. Market breadth favoured the gainers, with 3,116 stocks advancing, 734 declining, and 85 remaining unchanged. Among Nifty 50 stocks, Adani Ports, Tata Steel, M&M, and Adani Enterprises were the top performers. Conversely, Bajaj Finance, HDFC Bank, and ICICI Bank were the biggest decliners. Global markets have been shaken by extensive tariffs imposed by US President Donald Trump, sparking retaliatory actions and raising concerns about a global trade war on multiple fronts. On Tuesday, the US implemented a 25 per cent tariff on imports from Canada and Mexico, while Chinese goods now face a total duty of 20 per cent, following an added 10 per cent levy. In retaliation, both China and Canada have introduced reciprocal tariffs on US imports. Tensions further escalated when Trump threatened additional tariffs, set to take effect on April 2, with India in his sights, heightening fears of trade disruptions and increased market volatility. Beyond the immediate impact on trade, these tariffs could drive inflation in the US, potentially prompting the Federal Reserve to maintain higher interest rates for a prolonged period. This, in turn, may deter foreign investment in emerging markets such as India. Also Read: India's Services Activity Recovers In Feb As Inflation Slows Down, Demand Soars. Check PMI Data HERE Sectorial Update Despite global uncertainties, broader markets experienced a strong rebound, with the BSE Midcap and BSE Smallcap indices each rising by over 2 per cent. All 13 major sectoral indices finished in the green, with Nifty Auto, Nifty IT, Nifty Energy, Nifty Metal, Nifty PSU Banks, and Nifty Realty leading the way, each advancing by 2-4 per cent. Expert Comment "Nifty broke its 10-session losing streak, ending Wednesday’s trading up by 1.15 per cent at 22,337.30. The benchmark indices saw a strong recovery from the oversold zone. The pullback was driven by several factors, including strength in Asian markets, bargain buying in oversold stocks, and value buying in blue-chip stocks. All 13 major sectoral indices closed in the green, with Metals, Information Technology, and Automobile stocks leading the rally. The BSE Midcap and BSE Smallcap indices surged by 2.66 per cent and 2.8 per cent, respectively," according to Bajaj Broking Research.

Indian benchmark indices, Nifty and Sensex staged a strong rebound from oversold levels, closing the session on Wednesday with gains of around 1 per cent after a period of market decline. This rally puts the Nifty 50 on track to break its 10-day losing streak, marking a historic first.

Information technology, metal, and automobile stocks led the charge, offsetting losses in some key index heavyweights. However, analysts remain cautious about the sustainability of this recovery, as global financial markets continue to face uncertainty, with ongoing concerns over trade wars.

At the close, the Sensex jumped 740.30 points, or 1.01 per cent, to finish at 73,730.23, while the Nifty gained 254.65 points, or 1.15 per cent, ending at 22,337.30. Market breadth favoured the gainers, with 3,116 stocks advancing, 734 declining, and 85 remaining unchanged.

Among Nifty 50 stocks, Adani Ports, Tata Steel, M&M, and Adani Enterprises were the top performers. Conversely, Bajaj Finance, HDFC Bank, and ICICI Bank were the biggest decliners.

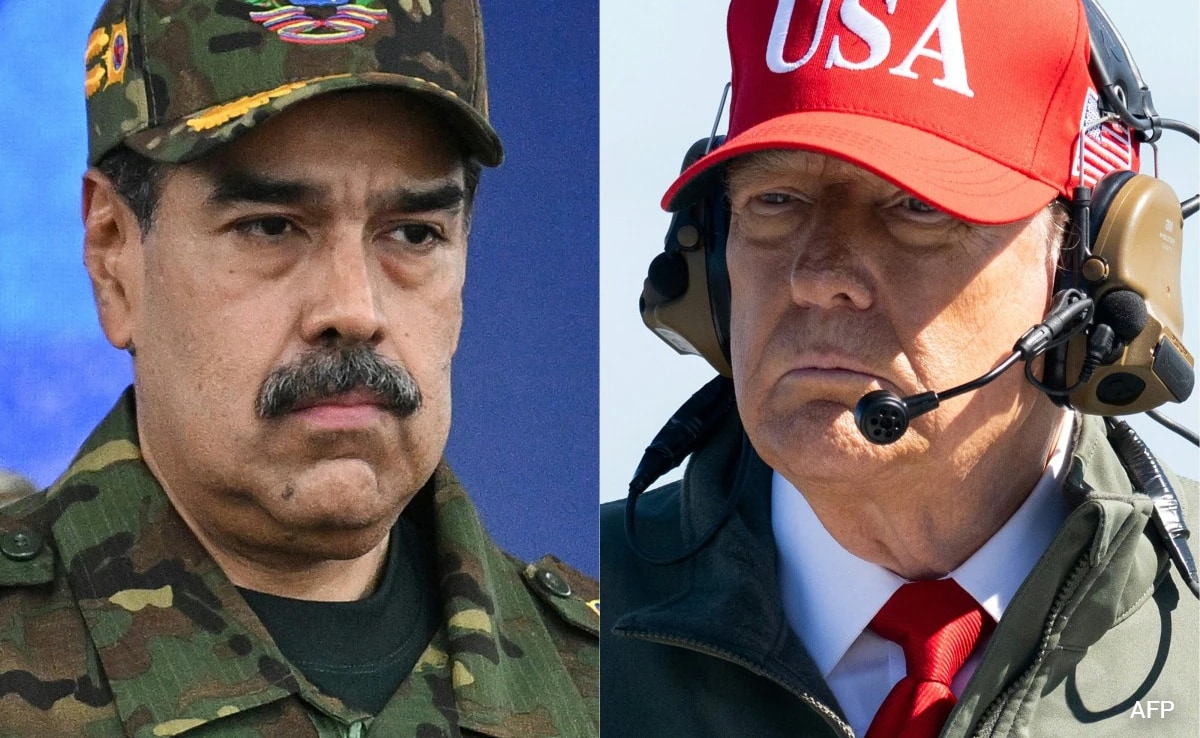

Global markets have been shaken by extensive tariffs imposed by US President Donald Trump, sparking retaliatory actions and raising concerns about a global trade war on multiple fronts. On Tuesday, the US implemented a 25 per cent tariff on imports from Canada and Mexico, while Chinese goods now face a total duty of 20 per cent, following an added 10 per cent levy. In retaliation, both China and Canada have introduced reciprocal tariffs on US imports. Tensions further escalated when Trump threatened additional tariffs, set to take effect on April 2, with India in his sights, heightening fears of trade disruptions and increased market volatility.

Beyond the immediate impact on trade, these tariffs could drive inflation in the US, potentially prompting the Federal Reserve to maintain higher interest rates for a prolonged period. This, in turn, may deter foreign investment in emerging markets such as India.

Also Read: India's Services Activity Recovers In Feb As Inflation Slows Down, Demand Soars. Check PMI Data HERE

Sectorial Update

Despite global uncertainties, broader markets experienced a strong rebound, with the BSE Midcap and BSE Smallcap indices each rising by over 2 per cent. All 13 major sectoral indices finished in the green, with Nifty Auto, Nifty IT, Nifty Energy, Nifty Metal, Nifty PSU Banks, and Nifty Realty leading the way, each advancing by 2-4 per cent.

Expert Comment

"Nifty broke its 10-session losing streak, ending Wednesday’s trading up by 1.15 per cent at 22,337.30. The benchmark indices saw a strong recovery from the oversold zone. The pullback was driven by several factors, including strength in Asian markets, bargain buying in oversold stocks, and value buying in blue-chip stocks. All 13 major sectoral indices closed in the green, with Metals, Information Technology, and Automobile stocks leading the rally. The BSE Midcap and BSE Smallcap indices surged by 2.66 per cent and 2.8 per cent, respectively," according to Bajaj Broking Research.

What's Your Reaction?